• • •

"Mike and Jon, Jon and Mike—I've known them both for years, and, clearly, one of them is very funny. As for the other: truly one of the great hangers-on of our time."—Steve Bodow, head writer, The Daily Show

•

"Who can really judge what's funny? If humor is a subjective medium, then can there be something that is really and truly hilarious? Me. This book."—Daniel Handler, author, Adverbs, and personal representative of Lemony Snicket

•

"The good news: I thought Our Kampf was consistently hilarious. The bad news: I’m the guy who wrote Monkeybone."—Sam Hamm, screenwriter, Batman, Batman Returns, and Homecoming

July 26, 2009

America The Confused

Mitch "Tuesdays with Morrie" Albom:

In explaining why it was OK to sock a new 5.4% tax on the highest earners in this country — to pay for health care reform — President Obama’s press secretary, Robert Gibbs, said this:“The president believes that the richest 1% of this country has had a pretty good run of it for many, many, many years.”

Ah. So that’s it. The old “You’ve had it good enough for long enough” policy. That’s why a family earning a million dollars a year should now cough up $54,000 of that — in addition to all the other taxes it pays...

It is not that the rich should not pay fair taxes. They should.

But to justify a grossly overweighted tax by saying “You people have had it good long enough” is to engage in the worst and most destructive form of politics: class warfare.

Ow, my head.

Someone making $1,000,000 per year wouldn't pay $54,000 more in taxes under this bill. They'd pay $9,000.

That's because the 5.4% surcharge would only apply to someone's income over $1,000,000. Your tax bill wouldn't suddenly go up by $54,000 if one year you made $1,000,000 instead of $999,999.

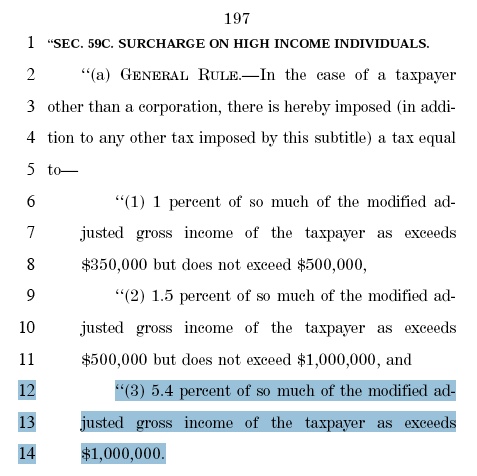

Here's how the proposed surcharge would actually work. There would be:

• an additional 1% tax on income between $350,000 and $500,000. Thus, if someone makes $500,000 per year, they would pay an extra 1% of $150,000, or $1,500.

• an additional 1.5% tax on income between $500,000 and $1,000,000. Thus, if someone makes $1,000,000 per year, they would pay an extra 1.5% of $500,000, or $7,500.

That's $9,000 more in taxes ($1,500 + $7,500), or 0.9%.

(Now, it is true that someone making $10 million per year would pay an additional $495,000. That would consist of the extra $9,000 on the first million plus 5.4% ($486,000) on the next $9 million.)

THE BEST PART: The best part is, Mitch Albom has a degree from the Columbia University's Graduate School of Journalism plus an MBA from Columbia's Graduate School of Business.

It took me five minutes to find the actual bill (pdf) online, and figure out he was off by a factor of six.

There really is no field but right-wing punditry where you can make these kind of catastrophic errors and keep your job. You can't graduate from Columbia Medical School and become a surgeon if you believe human beings have six spleens, and you can't stay an anesthesiologist if you give someone six times too much Sevoflurane. But as long as your horrifying incompetence serves a right-wing agenda, there will always be a cozy home for you in journalism.

—Jonathan Schwarz

Posted at July 26, 2009 01:38 PM"The best part is, Mitch Albom has a degree from the Columbia University's Graduate School of Journalism plus an MBA from Columbia's Graduate School of Business."

You neglected to mention his honorary Doctor of Letters degree from Stutts University.

Posted by: jm at July 26, 2009 03:28 PMMAKE MEDICARE/MEDICAID THE SINGLE PAYER, call Pelosi @1-202-225-0100. Even 5.4% is not that bad. I'm willing to say that I can SEE the benefit of paying that percentile were I a minimum wage earner AND that's what it cost me.

Posted by: Mike Meyer at July 26, 2009 03:30 PMMr. Albom is simply being what the economists call a "rational actor".

I now realize why Morrie didn't mind seeing Mitch every Tuesday: It must have made the prospect of having to leave this world a little less painful. Plus, Mitch got a book deal. This is what the econmists (or somebody) call "win-win".

Posted by: cemmcs at July 26, 2009 07:48 PMI notice you have to register to post comments there, and it seems like you have to click on comments individually to read them, so I'm wondering--has anybody pointed out this rather major error in accounting to Albom?

Of course, accuracy was never his strong suit. I seem to recall him sending out a story on an event (political or sports?) before the actual event had taken place.

Posted by: Lolly at July 26, 2009 08:46 PMI put it less to a case of right wing agenda, and more to a case of it being that Americans have sucky Math scores.

Posted by: En Ming Hee at July 26, 2009 09:05 PMI would chuck it off to Mitch being inept at math, not as being a water carrier for the right.

His radio program is an oasis in an otherwise fully inundated right wing station.

Posted by: Dahoz at July 26, 2009 09:13 PM"Mr. Albom is simply being what the economists call a "rational actor"."

People, like Mr. Albom, who cannot understand the relatively simple concept of a marginal tax rate are also what many economists call either "stupid" or "deliberately obtuse".

Not only is this proposal a tax on marginal income, it is a tax on marginal modified adjusted gross income. In other words, the poor family earning $1,000,000 per year that Mr Albom is so concerned about actually had income considerably higher than that. This, of course, means their effective tax rate is even lower than the marginal rate

I would chuck it off to Mitch being inept at math, not as being a water carrier for the right.

Whether or not Albom is a right-wing pundit, this was most definitely right-wing punditry.

Moreover, it's especially galling coming from a writer and radio host. Every single bite of food he's ever eaten is thanks to (1) the government protecting his copyright, and (2) the government handing over our public property (the airwaves) to him for nothing so he can make money off it. Yet he's utterly blind to the massive give-away he's received. He might as well be a top executive at Citigroup wailing about how unfair it is for him to have to pay taxes just after the government handed his company $45 billion.

Posted by: Jonathan Schwarz at July 26, 2009 09:39 PMNot only is this proposal a tax on marginal income, it is a tax on marginal modified adjusted gross income.

Right. I left that out because I figured a concept that complex would actually cause his brain to explode.

Posted by: Jonathan Schwarz at July 26, 2009 09:44 PMWhat you're missing is the actually important information: this surtax will raise peanuts. As of 2007 (the numbers are smaller now), there were 2.9 million millionaires in the US. Mind you, that includes all the people with that much net worth, which means the real number of people with that level of income is smaller (probably a lot smaller).

Even if we assume the 2.9 million, raising $9000 from each one brings in a whopping $26 billion. Given that the CBO has estimated the cost of the health plan at $10 trillion over a decade, this tax would bring in around 1/5th of the amount you need (actually less, since my figures are off and this is a static analysis).

Since you like math, I'm sure you know all this - which means yeah - this is class warfare, and has nothing to do with actually paying for health care...

Posted by: James Robertson at July 26, 2009 09:47 PMMath has never been one of Mitch's strong points

Posted by: Jamie at July 26, 2009 09:49 PMEven if we assume the 2.9 million, raising $9000 from each one brings in a whopping $26 billion.

Ouch! The stupid really DOES burn!

Posted by: Jonathan Schwarz at July 26, 2009 09:55 PMTo put some meat on Jonathan Schwarz's observation that the stupid really does burn, the (deliberately obtuse?) oversight of James Robertson is while Albom's hypothetical barely millionaire family pays only $9,000, rather than the $54,000 that Albom is complaining about, lots of people make a lot more than a "mere" million, and they will indeed pay more than $9,000 each. If your adjusted gross income is $10,000,000, this surcharge will cost you about $495,000. With $100 million adjusted gross income, you'll pay $5,355,000 with this tax. And with $5 million in adjusted gross income, you'll pay $225,000.

I have no idea what the actual average income is of people who make over $1,000,000, but for a sense of scale, let's say that the average is $3,000,000 (I'd guess that's low). Then the tax will collect 2.9 million times $117,000, or $339 billion. Not a trivial sum of money.

In fact, Robertson's original point is ... pointless. $26 billion sounds small compared to the $1 trillion that's being bandied about, until you remember that that's a 10-year figure, so the cost is about $100 billion a year. Even if Robertson's number were correct, it would still be covering about 1/4 of the cost.

Deliberately obtuse, or just not trying very hard? You decide.

Posted by: Karl at July 26, 2009 10:33 PMjust a small Q - are marginal tax rates not taught in schools?

we here in india are told what our tax rates will be right from school...at least the relatively privileged schools i was lucky to attend, it was part of the syllabus in this class we were forced to take called 'civics'.

100 million CLIENTS of the "No American Has To Hear The Word No Medicare/Medicaid Health Insurance Policy, in that WHATEVER Doctor and Patient AGREE upon is paid for and subject to review by Medicare", EACH PAYING 100 dollars per month= 10 BILLION PER MONTH= 120 billion per year=1.2 trillion IN 10 YEARS.

Posted by: Mike Meyer at July 26, 2009 10:42 PMSince the poor, homeless, elderly will need their premiums subsidized charge according to income level to maintain an overall average of 100-200 per month over the 100 million. MORE CLIENTS LOWER COSTS.

Posted by: Mike Meyer at July 26, 2009 10:48 PMjust a small Q - are marginal tax rates not taught in schools?

When you get your first full-time job and it pays lower middle-class or less (like most entry level jobs), you learn a life-time lesson in marginal tax rates as you do your own tax return.

So, I would guess that Mitch Albon got yet another free-ride in the game of life.

Posted by: J Edgar at July 26, 2009 11:00 PM"...I'm sure you know all this - which means yeah - this is class warfare, and has nothing to do with actually paying for health care...>"

Of course it's class warfare. When has there not been class warfare?

The real issue is who's winning. The thirty or so years following World War II--a period Paul Krugman calls the Great Compression--saw some of the highest marginal income tax rates in U.S. history. It was unquestionably the largest downward redistribution of wealth in human history. (In other words, no doubt, it was class warfare.) It also was when the American middle class as we know it today, the true legacy of the Greaterest Generation, was formed.

Over the most recent thirty or so years class warfare has continued to rage, but those in the far right tail of the income distribution have prevailed. They have seen their share of total income grow at rates the most malignant of cancers would be envious of (if, you know, cancers were capable of feeling envy). Finally, people of more modest means are realizing the real world implications of income inequality, aka one particular outcome of class warfare, and they are beginning to fight back.

Class warfare is an inescapable condition of human existence. Why shouldn't the class with the overwhelming majority of the population fight in its own self interest? Class warfare is not necessarily a bad thing.

Posted by: jm at July 26, 2009 11:04 PMGiven that the CBO has estimated the cost of the health plan at $10 trillion over a decade...

Actually, the CBO estimate is $1 trillion over ten years, not $10 trillion.

But hey, he's just off by an order of magnitude.

Posted by: SteveB at July 26, 2009 11:22 PMSigh. I said I was using back of the envelope numbers. The CBO estimated that the surtax (and this was the earlier one that started on couples making $350k) would bring in about 50% of the money needed to fund the health care proposals in the house - about $500B, when the total 10 year cost was $1T (yes, I typed in an extra zero above. So sue me).

The point (something you missed), is simple: the surtax doesn't work. It doesn't fund the proposal. You're left having to:

-- issue more debt, or

-- layer taxes further down the income chain (you know, hitting that 95% that President Obama said would be left harmless).

So go ahead, laugh. Meanwhile, your proposal is going down in flames, because it's getting to be hugely unpopular (watch the Rasmussen tracking polls; don't take my word for it).

Posted by: James Robertson at July 27, 2009 12:04 AMWhile I realize we've been trying to deal with hard numbers and not idle speculation in this comment thread, I suspect part of the reason Obama and others have been so vague about the details of how healthcare reform is supposed to work is because they mean to pay for in large part by diverting funds from medicare(FICA) taxes, which of course are regressive in nature.

Obama hasn't said this directly, but he has noted that the reform bill would save the medicare program money, and has said he would be open to an up-or-down vote on budgetary and tax aspects of the bill, which I read as code for I'm going to let the GOP "force" me to tax medicare to get my bill passed. If McCain tried the same stunt I imagine the lefty blogosphere would call him on it, but as you said Jon, love is blind and the stupid hurts. OK, so I embellish about what you actually said...

from the conference call(MP3 link)to various bigshot bloggers he made last week:

http://crooksandliars.com/medialoader/9095/310b9/mp3/President-Obama-Conference-call-John-Amato.mp3

Posted by: Jonathan Versen at July 27, 2009 12:06 AMMitch used to be a sports reporter for the Detroit Free Press . When the workers and reporters went on strike to save their union and benefits Mitch was quick to cross the picket lines. I will never forget that scab mother fucker.

Posted by: nameless bob at July 27, 2009 12:13 AMDeliberately obtuse, or just not trying very hard?

Neither. He's genuinely very, very, very stupid.

Posted by: Jonathan Schwarz at July 27, 2009 12:16 AMWow, James Robertson! I remember when he used to troll Balloon Juice!

Your back-of-the-envelope calculations suck. You assume that every one of the people with $1 million incomes makes exactly $1 million a year. And you're ignoring everyone who makes over $350,000, because each of them will also be paying a surtax. You made up numbers that don't mean anything and declared that they're simultaneously too much money and not enough. Why do you even bother posting this crap?

Posted by: scarshapedstar at July 27, 2009 12:49 AMbecause it's fun.

Posted by: Not Exactly a James Robertson at July 27, 2009 12:58 AMThe vital part of the argument that seems to always be left out is that the cost of this "health plan" is compared with -- nothing...as though we are paying nothing for health care now. $1 trillion or so over the next ten years is peanuts compared to what we will be paying if current trends continue.

Posted by: steve the artguy at July 27, 2009 03:18 AMA lot of people don't understand marginal tax rates, even those who actually pay taxes, fill out the forms.

I remember I was working for a software company in the nineties, we were having a cigarette break (good old times) with the guy who was probably the most talented software developer in the company - really, really smart software-wise - when he started complaining about paying X% of his income in taxes, where X was the marginal rate for his income. I tried to explain, but he simply refused to believe. He was dead-set on the idea that marginal rate is the effective rate; nothing I could do. Go figure.

Posted by: abb1 at July 27, 2009 04:47 AMMitch Albom...if you distill his radio show down to the bare elements you get mostly self-promotion (whichever book/movie/play he's just finished) with a smattering of sports and current-events discussion. Pretty thin gruel, but hey - he's pissed that he may have to pay more in taxes.

Posted by: mcair at July 27, 2009 06:59 AMOuch! Someone pulled out the old "Look at the Rasmussen pollling" tripe. It's a variation on the now-current "Obama's dropping like a rock" dutifully posted by comment trolls and Michelle Bachmann.

The trolls never, ever refer to polls by other, more repected pollsters, and those who follow polling know that in between elections Rasmussen makes its money by releasing polls favorable for Republicans.

The truth is that Obama is very, very popular, although his popularity has slipped abit from its high of 63-65% at inauguration o 55-59% this month (http://www.pollingreport.com/obama_job.htm).

In addition, health care reform as it is being proposed is very popular, with 56% answering "It is more important than ever to take on health care reform now" and only 39% answering "we cannot afford to take on health care reform right now" when given that choice of statements. Even further, 58% would favor "Having a national health plan in which all Americans would get their insurance through an expanded, universal form of Medicare-for-all" (http://www.pollingreport.com/health.htm).

Posted by: Daddy Love at July 27, 2009 09:14 AMyes, I typed in an extra zero above. So sue me

Yeah, I wonder how that happened, since the zero is all the way at the other end of the keyboard from the one. You should have gone for $12 trillion, it makes for a much more convincing typo.

Posted by: SteveB at July 27, 2009 09:15 AMNearly a $trillion/year for Defense comes out to $10trillion over a decade. How the fuck are we going to pay for THAT!

James, crank up that magic calculator of yours and tell us.

Posted by: bobbyp at July 27, 2009 09:32 AMI could care less about his horrible math skills. A millionaire who whines about the current US tax code being harsh enough and that an additional $54,000 is just too much to ask (especially for something as fundamental as healthcare) is one truly greedy bastard. The rich don't pay enough taxes considering the declining condition of the rest of the citizens in this country. We have indeed reached the point where the government needs to provide a little 'stimulus' to curb the greed that has ruined our economy. If you want to be greedy then when you win be prepared to give a greater percentage of it back to make right the damage you have done to your less greedy neighbors.

Posted by: Ricky at July 27, 2009 10:44 AMMaybe the new GOP slogan ought to be:

"America: Not Worth Paying For!"

Posted by: scarshapedstar at July 27, 2009 12:07 PMI guess Morrie never took the time to explain to Mitch how progressive tax rates work.

Posted by: Alex at July 27, 2009 12:21 PM"Whatcha got there, numbers?"

-Bender

Why do some people use the phrase "class warfare" like it is a bad thing?

Posted by: me at July 28, 2009 12:11 AMMitch Albom has no stomach for class warfare because he's a cheese-eating class surrender monkey.

Posted by: SteveB at July 28, 2009 07:24 AMHonestly, I think it was only last year I saw tax marginal rates well explained in a mainstream publication. That doesn't let Albom off the hook at all, since he should know and/or do his homework -or he's just counting on his audience not knowing. It's pretty rare for the corporate media to explain the degree of wealth inequity in America, and how much it increased again under Reagonomics and its variations. Outside of Krugman, David Cay Johnston and some others, it's uncommon to hear anyone describe class warfare waged by the rich, or to explain how a more progressive tax code is both more fair and better for the economy as a whole. Funny, that.

Posted by: Batocchio at July 28, 2009 04:25 PMJon - you missed this beautiful analysis (or maybe you didn't - I just found your blog):

http://www.nypost.com/seven/07162009/news/regionalnews/dem_health_rx_a_poion_pill_in_ny_179525.htm?page=2

Posted by: inthewoods at July 28, 2009 09:14 PMThat's what Mitch does: he makes hsit up!

Posted by: elbrucce at July 29, 2009 12:33 AM